The world of investing is constantly evolving, shaped by a myriad of factors, and influenced by global trends.

From the growth of hedge funds and cryptocurrency investments to the resilience of real estate and the dynamics of foreign investment flows, this article explores key statistics that provide insights into the ever-changing landscape of investment opportunities.

Our table of contents that we want to cover is very long and informative, so let’s get started.

General Investment Statistics

1. Investor acquisitions rose across the core markets to $586.9 billion, which is double the $293.4 billion level in 2021. (Commercial Market Insights)

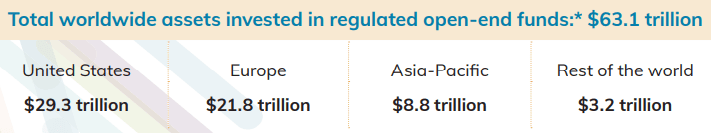

2. Total worldwide assets invested in regulated open-end funds was $63.1 trillion. (Investment Company Institute)

3. US-registered investment companies held assets that totaled a whopping $29.7 trillion. (Investment Company Institute)

4. The total funds in the retirement market was $34.9 trillion. (Investment Company Institute)

Stock Market Statistics

1. After a year of macroeconomic and geopolitical shocks, investors responded by derating the S&P 500 price-to-earnings (P/E. ratio as much as seven times. (Statista)

2. Some speculative segments of the stock market crashed as much as 70-80% from highs. (Statista)

3. It is predicted that the Fed will start signaling a pivot, pushing the S&P 500 to 4,200 by year-end 2023. (Statista)

4. The value of the global domestic equity market increased from 65.04 trillion U.S. dollars in 2013 to 121.94 trillion U.S. dollars in 2021. (Statista)

5. EU real GDP fell 14% by mid-2020 due to the pandemic’s impact. (EIB)

6. Real investment in the European Union fell by 14.6% by the end of Q2 2020. (EIB)

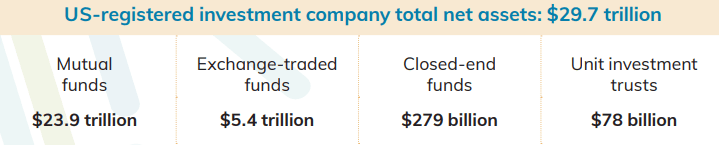

7. The global CIB industry’s return on equity (ROE. is estimated to decline by four-to-five percentage points due to new regulations. (McKinsey)

8. The capital markets businesses of the top 13 investment banks will experience a 65% drop in ROE post-regulation. (McKinsey)

9. The new market-risk framework will more than double the capital requirement for market-risk risk-weighted assets (RWAs. or RWA equivalents. (McKinsey)

10. Counterparty-risk charges will increase by a factor of about 2.5, impacting OTC derivatives. (McKinsey)

11. Scale increases linked to major revenue and cost productivity gains in capital markets. (McKinsey)

12. EU firms experienced a drop in sales due to the pandemic. 49% of them experienced this. (EIB)

Stocks And Mutual Funds Investment Statistics

People invest in stocks all the time as a form of investment statistics. As far as the sizes of the stock exchanges are concerned, New York Stock Exchange comes first, with London Stock Exchange in the runners-up position.

1. The number of qualifying hedge funds captured in this exercise has increased, since 2018, by 19% to 2,546. (IOSCO)

2. In the two years since the last hedge funds survey, assets under management (AuM), as captured by the survey, increased by 6% to $US4.07 trillion. (IOSCO)

3. 61,120 Open-ended Funds (OEFs. have been captured by this exercise, representing a total AuM of $US43 trillion. (IOSCO)

4. Equity funds are the most predominant type of OEFs, with the largest asset holding in physical cash equities. (IOSCO)

5. Closed-ended Funds (CEFs. captured by the exercise totaled 19,072 with a total AuM of $US2.6 trillion. (IOSCO)

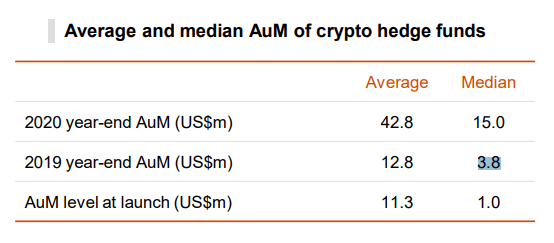

6. The percentage of crypto hedge funds with AuM over US$20 million increased in 2020 from 35% to 46%. (PwC 2021)

Stats on Commodities Investment

1. 15.2% growth in ICOs, with approximately 11.5 billion USD raised in 2018. (Arxiv)

2. Liquidity pressures and property devaluation impacted REIT portfolios. (Deloitte)

3. Repositioning for recovery involves deepening tenant relationships, strategy refinement, and commitment to ESG. (Deloitte)

4. The residential property market saw sales surge due to low-interest rates. (Deloitte)

5. Industrial property has shown resilience with rental growth of approximately 3% and low vacancies. (Deloitte)

6. The United States accounted for 41.3% of the MSCI Global Annual Property Index in 2019. (MSCI)

7. Sweden experienced the highest residual factor of 14.7% in market size estimate changes. (MSCI)

Stats on Investments in Businesses

1. Survey conducted in 2019 with 2,400 foreign investors in 10 middle-income countries. (World Bank)

2. Policy uncertainty due to protectionism and economic nationalism affects investment decisions. (World Bank)

3. Less than half of foreign businesses planned to expand investment in the next three years. (World Bank)

4. Factors influencing investment decisions: political stability, macroeconomic stability, legal and regulatory environment. (World Bank)

5. The global stock of institutional-grade real estate will expand by over 55% by 2020. (PwC 2020)

6. The volume of building activity is expected to double, with global construction output reaching $15 trillion by 2025. (PwC 2020)

7. Technology innovation and sustainability will be key drivers for value in the real estate industry. (PwC 2020)

8. Collaboration with governments will become more important for real estate managers and developers. (PwC 2020)

Real Estate Investment Statistics

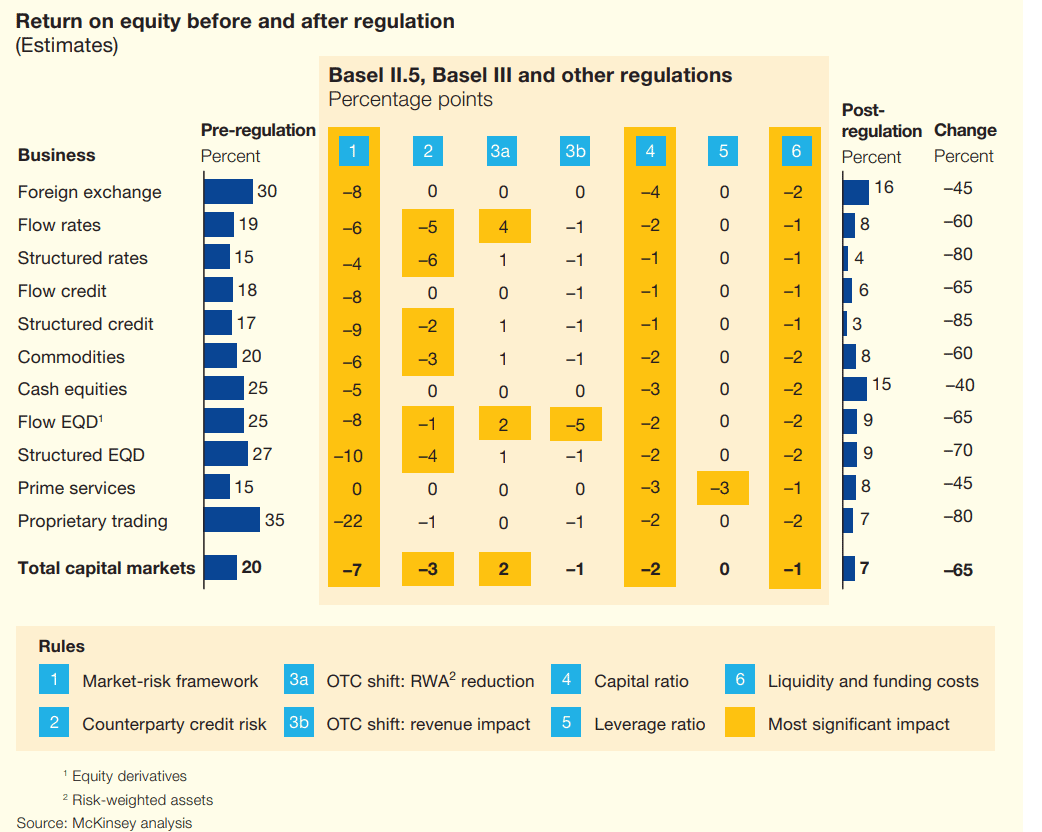

1. Investor Outlook and Activity: 75% of investors expect an increase in their US real estate investment activity in 2021. (AFIRE)

2. 6 in 10 investors foresee revenue growth. (AFIRE)

3. Austin, Boston, and Dallas are the top three US cities for planned investment in the current year. (AFIRE)

4. Multifamily properties are the most favored property type, with 86% intending to increase exposure in the next three to five years, followed by industrial properties at 79%. (AFIRE)

5. Concerns and Risk Management: Changes in tenant demand, economic inequality, climate change, and economic growth are among the key areas of concern impacting US real estate activity. (AFIRE)

6. 90% of investors view environmental, social, and governance (ESG. principles as increasingly imperative over the next three to five years. (AFIRE)

7. 30% of investors already require new investments to meet established ESG criteria. (AFIRE)

8. Tertiary cities, such as Austin, are gaining more interest from investors, with more than 6 in 10 respondents expecting to increase their investment in these cities in the next three to five years. (AFIRE)

Investment in Foreign Economies

1. Global foreign direct investment (FDI. flows in 2021 were $1.58 trillion. (World Investment Report 2022)

2. FDI flows to Africa reached $83 billion, from $39 billion in 2020. (World Investment Report 2022)

3. In Asia, FDI rose to an all-time high of $619 billion. (World Investment Report 2022)

4. Foreign direct investment in Latin America and the Caribbean rose by 56 percent to $134 billion. (World Investment Report 2022)

5. The US contributed $367 Bn to FDI in 2021, up from $151 Bn in 2020. (World Investment Report 2022)

6. Global FDI flows dropped by 24% in 2022 to USD 1,286 billion. (OECD)

7. Excluding Luxembourg, global FDI flows declined by 5% in 2022. (OECD)

8. Major FDI recipients, including China and the United States, recorded lower FDI flows in 2022. (OECD)

9. The United States and China were the top two FDI destinations worldwide in 2022. (OECD)

10. Brazil received a peak level of inflows in 2022 due to increased reinvestment of earnings. (OECD)

11. FDI inflows in OECD economies fell by 26%. (OECD)

12. FDI inflows in non-OECD G20 economies dropped by 38%. (OECD)

13. FDI outflows from OECD and non-OECD G20 countries plunged by 14% and 28%, respectively. (OECD)

Investment in Cryptocurrency

1. The total assets under management of crypto hedge funds globally increased to nearly $3.8 billion in 2020, up from US$2 billion in 2019. (PwC 2021)

2. 54% of investors in crypto hedge funds are high-net-worth individuals. (PwC 2021)

3. The median crypto hedge fund returned +128% in 2020. (PwC 2021)

4. 21% of hedge funds are investing in digital assets, with an average of 3% of all their assets being invested in digital assets. (PwC 2021)

5. The median ticket size is US$0.4 million, while the average ticket size is US$1.1 million. (PwC 2021)

6. Over half of crypto hedge funds have average ticket sizes of US$0.5 million and below. (PwC 2021)

7. Crypto hedge funds have a median of 23 separate investors. (PwC 2021)

8. The most common crypto hedge fund strategy is quantitative (37% of funds), followed by discretionary long/short (28%), discretionary long-only (20%), and multi-strategy (11%). (PwC 2021)

9. The median number of investors in funds is 23, and the average is 70.1. (PwC 2021)

10. Bitcoin is the largest cryptocurrency with over $14 billion market capitalization. (Morgan Stanley)

11. Bitcoin liquidity has significantly increased, with over $25 billion in daily average volume at major exchanges.

12. Bitcoin is the first cryptocurrency, designed in 2008 by Satoshi Nakamoto, and still accounts for around 55% of the total cryptocurrency market. (Morgan Stanley)

Final Thoughts

The statistics on investing reveal several notable trends. Hedge funds and open-ended funds continue to grow in assets under management. Cryptocurrency investment has experienced significant growth, with increased hedge fund AuM and positive returns with higher market value. But the future of this market is still uncertain due to a lack of long-term historical data.

Real estate investment remains a popular choice, driven by investor optimism and interest in sustainable practices. Foreign investment flows have fluctuated due to various factors.

Overall, the investment landscape is dynamic, influenced by market conditions, regulatory changes, and evolving investor preferences. It is crucial for investors to stay informed and adapt their strategies accordingly.